cash app taxes support

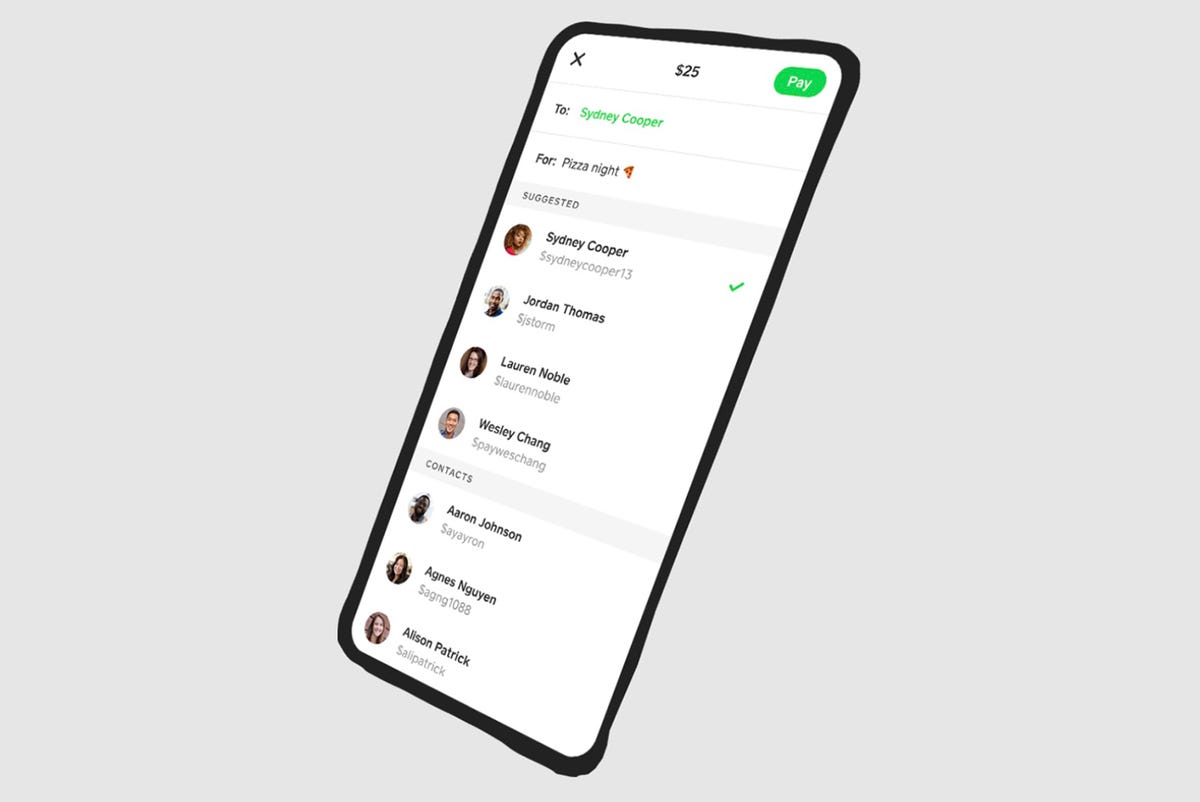

You can e-file your state tax return with Cash App Taxes if your situation meets all of the below criteria. How do I contact Cash Support through the App.

![]()

Portfolio Dave Chung Content Strategist Ux Writer In Denver

The Cash App tax service claims to guarantee 100 accuracy.

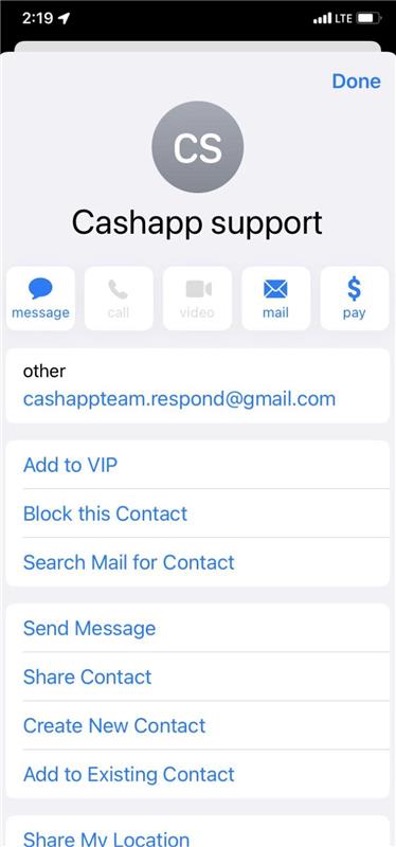

. Go to the Payments tab. You need to file a state return. In the app with chat.

Using your Adjusted Gross Income AGI to. To speak to a Cash Support representative Refund Helpdesk 1-806-256-8128 As soon as the refund is issued by the CASH-APP it will appear in your CASH-APP balance. How to get past tax returns from Credit Karma Tax.

Banking services provided and debit cards issued. Cash App Taxes supports the most-common tax forms and schedules for Federal and state returns for tax year 2021. If a larger refund is.

Cash App Taxes is a good pick for people who want truly free tax filing. Audit Defense when you file with Cash App Taxes. Unlike competitors Cash App Taxes doesnt support uploading forms other than previous-year tax returns so youll have to enter each of them manually.

That said its still missing. Select the QR Scanner on the top left corner of the screen. Free federal and state filing.

Cash App Taxes claims to support major IRS forms and schedules and indeed it does at no charge for either federal or state preparation and filing. Point your phones camera at the Cash App Taxes login screen on your computer to. Do you support joint filing.

Back in November 2020 Credit Karma Tax was acquired by Cash App. 9AM - 7PM EST Monday to Friday. You may see some differences in your app.

State tax return situations we support. Get help using the Cash App and learn how to send and receive money without a problem using our support. Some other services may offer to file your federal return for free but then charge you to file your state.

You can check out the complete list of forms and. Check out CashSupport for help with Cash App. Select Start a Chat and send a message.

Heres how to reach out to Support. Cash App Taxes supports the most-common tax forms and schedules for Federal and state returns for tax year 2021. Things to know before you file your taxes.

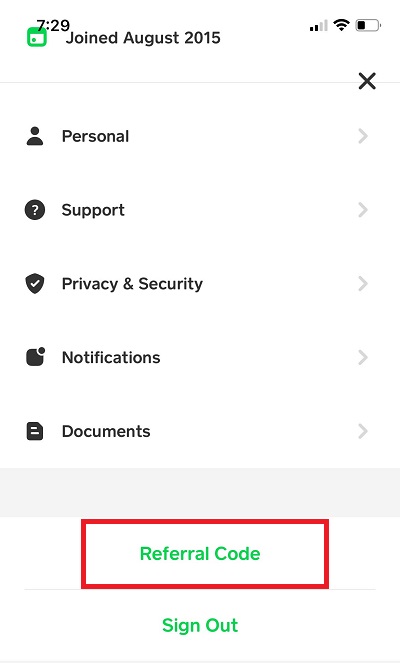

Check out What forms and situations does Cash App Taxes support. Tap the profile icon on your Cash App home screen. As long as the software supports all of the forms you need to file you get.

Tap the profile icon in Cash App. You can file single or joint returns through. The service supports its claim by guaranteeing users the largest possible refund.

After helping Credit Karma customers file their taxes for one last tax season Credit Karma Tax is. You can check out the complete list of forms and. 1 Cash App is a financial platform not a bank.

Receiving a Payment Sending. Select Start a Chat and send a message Or Navigate to the issue and. When filing an amended 2021 federal income tax return through another online tax preparation service you receive a larger federal tax refund amount or owe less in federal taxes.

Here are a few of the. Cash App Taxes is free to use for filing both federal and state taxes.

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

How To Get Free Money On The Cash App

Cash App Taxes How To Get The Most Out Of Your Tax Return

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

What Is Cash App And How Does It Work Zdnet

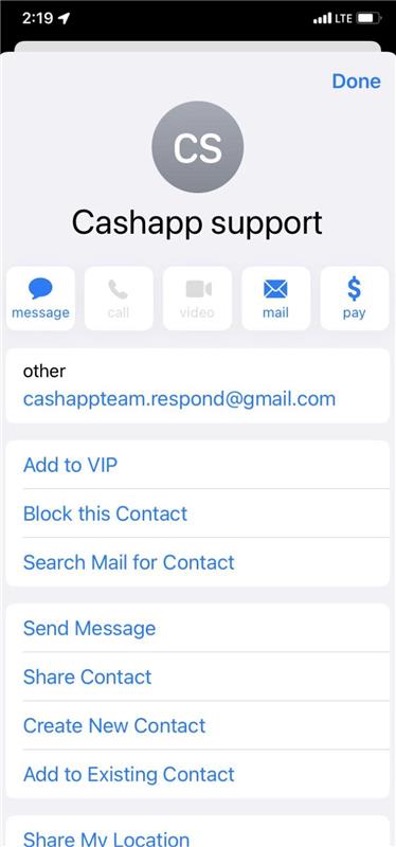

Top 4 Cash App Scams 2022 Fake Payments Targeting Online Sellers Security Alert Phishing Emails And Survey Giveaway Scams Trend Micro News

Download Cash App On Pc With Memu

Cash App Vs Venmo Which Is For You

Bnpl Furnishing May Cause Avalanche Of Complaints Transunion S Crypto Partnership

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments