san francisco payroll tax rate 2021

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment.

Stellen Bei Asana In San Francisco Usa Karriere Bei Asana Asana

What is the sales tax rate in San Francisco California.

. When an employee hits the overtime period they are entitled to 15 times or even 2 times their regular pay. 2021 Annual Business Tax Returns. The Gross Receipts Tax replaces the Payroll Expense Tax for 2021 and increases the tax rates on most industries.

We have posted our schedule of payroll tax rates and wage bases. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation. Giants Luxury Tax Payroll.

Payroll Expense Tax. Proposition F proposes several changes to the taxes the city collects from San Francisco businesses including. The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20.

Ad Process Payroll Faster Easier With ADP Payroll. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Additionally businesses may be subject to up to four local San Francisco taxes.

List of Employee Employer Payroll Taxes by US City State. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. 2021 Tax Threshold 210000000.

This measure would increase that tax as well to. 2021 Alabama Payroll Taxes - 2021 Alabama Payroll Tax Calculator. Depending on the business.

This is the total of state county and city sales tax rates. It is that time of year again to update you on the payroll regulations for the 2020 2021 calendar years. Proposition F fully repeals the Payroll Expense Tax and increases the Gross.

Eliminating the payroll expense tax beginning in the. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. 8 hours in a workday.

Companies subject to the Gross Receipts Tax need to file it as part of their. City and County of San Francisco 2000-2021. Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense.

SJWC miscalculates the Ad 4 Valorem tax rate of. 2 The Commission should approve an Ad Valorem tax rate of 12 for TY 2022 3 because the tax rate is based on more recent SJWC data. Discover ADP For Payroll Benefits Time Talent HR More.

The Administrative Office Tax AOT is a 14 percent tax on the San Francisco payroll expense of a. The minimum combined 2022 sales tax rate for San Francisco California is. Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax instead of a gross receipts tax.

14 San Francisco Business and Tax Regulations Code Article 12-1-A 953. Get Started With ADP. Tax rate for nonresidents who work in San Francisco.

For more information about San Francisco 2021 payroll tax withholding please call this phone number. For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity. 15 x regular rate of.

Ad Process Payroll Faster Easier With ADP Payroll. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor. The assessed value is initially set at the purchase price.

Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan. In most cases youll be credited back 54 of this amount for paying. Get Started With ADP.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Presidio of Monterey Monterey. Discover ADP For Payroll Benefits Time Talent HR More.

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Gross Receipts Tax Clarification

Annual Business Tax Return Treasurer Tax Collector

Overpaid Executive Gross Receipts Tax Approved Jones Day

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

San Francisco Gross Receipts Tax

Annual Business Tax Returns 2021 Treasurer Tax Collector

Seattle S Tech Scene Looks Like San Francisco S Did 10 Years Ago What Gives Sf Citi

Kdv Tax In Turkey Tax Turkey Value Added Tax

San Francisco Taxes Filings Due February 28 2022 Pwc

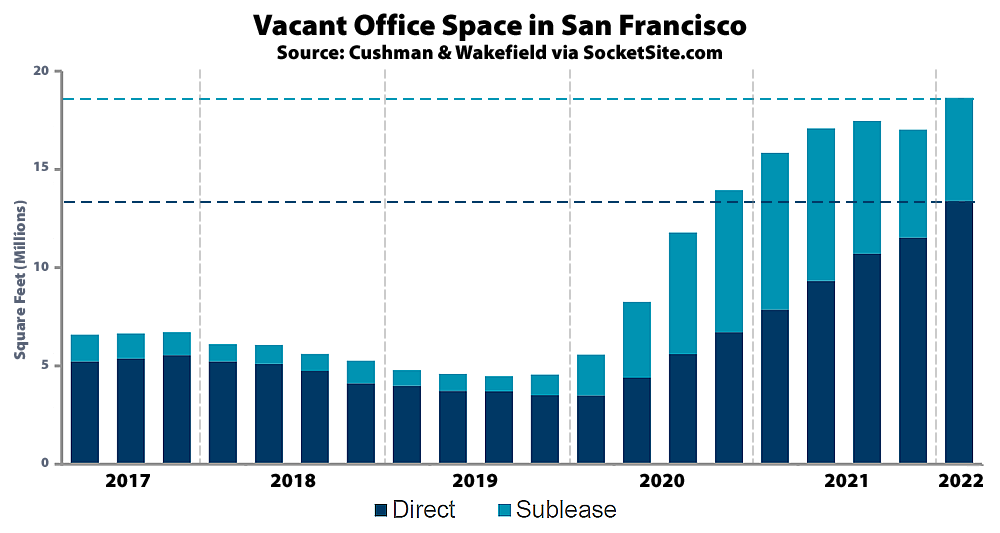

Office Vacancy Rate In San Francisco Hits A Pandemic High

Annual Business Tax Return Treasurer Tax Collector

San Francisco Giants Average Attendance 2021 Statista

California San Francisco Business Tax Overhaul Measure Kpmg United States

San Francisco S New Local Tax Effective In 2022

Working From Home Can Save On Gross Receipts Taxes Grt Topia